Time for a more radical Europe

- Martin Enlund

- 3/9/25

Last fall, Italian economist Mario Draghi, former head of the European Central Bank (ECB), published his 400-page report on Europe’s (actually the EU’s) competitiveness. Draghi’s verdict was harsh: Europe is facing an “existential challenge.” It’s hard to disagree. While the EU is launching new regulations on plastic corks and hiding text messages from the public, Elon Musk is changing the world with groundbreaking innovations in the automotive, robotics, and space industries.

Pride comes before a fall

- Martin Enlund

- 3/31/24

The Governor of the Swedish Central Bank, Erik Thedéen, recently expressed significant skepticism about Bitcoin and cryptocurrencies as a phenomenon, dismissing Bitcoin as “an instrument for pure speculation.” He also pointed out that if there is no possibility to expose oneself to Bitcoin in the Swedish financial system, it might end up “more in criminal hands.” The European Central Bank is on the same track. In a recent blog post, they amused themselves by comparing Bitcoin ETFs to “the Emperor’s new clothes.”

KYC is the real terror

- Martin Enlund

- 3/21/24

It has become increasingly evident that our financial system has started undermine our constitutionally guaranteed freedoms and rights. Payment giants like PayPal, Mastercard, and Visa sometimes block the ability to donate money. Individuals, companies, and associations lose bank accounts — or struggle to open new ones. In bank offices, people nowadays risk undergoing something resembling being cross-examined. The regulations are becoming so cumbersome that their mere presence risks tarnishing the banks’ reputation.

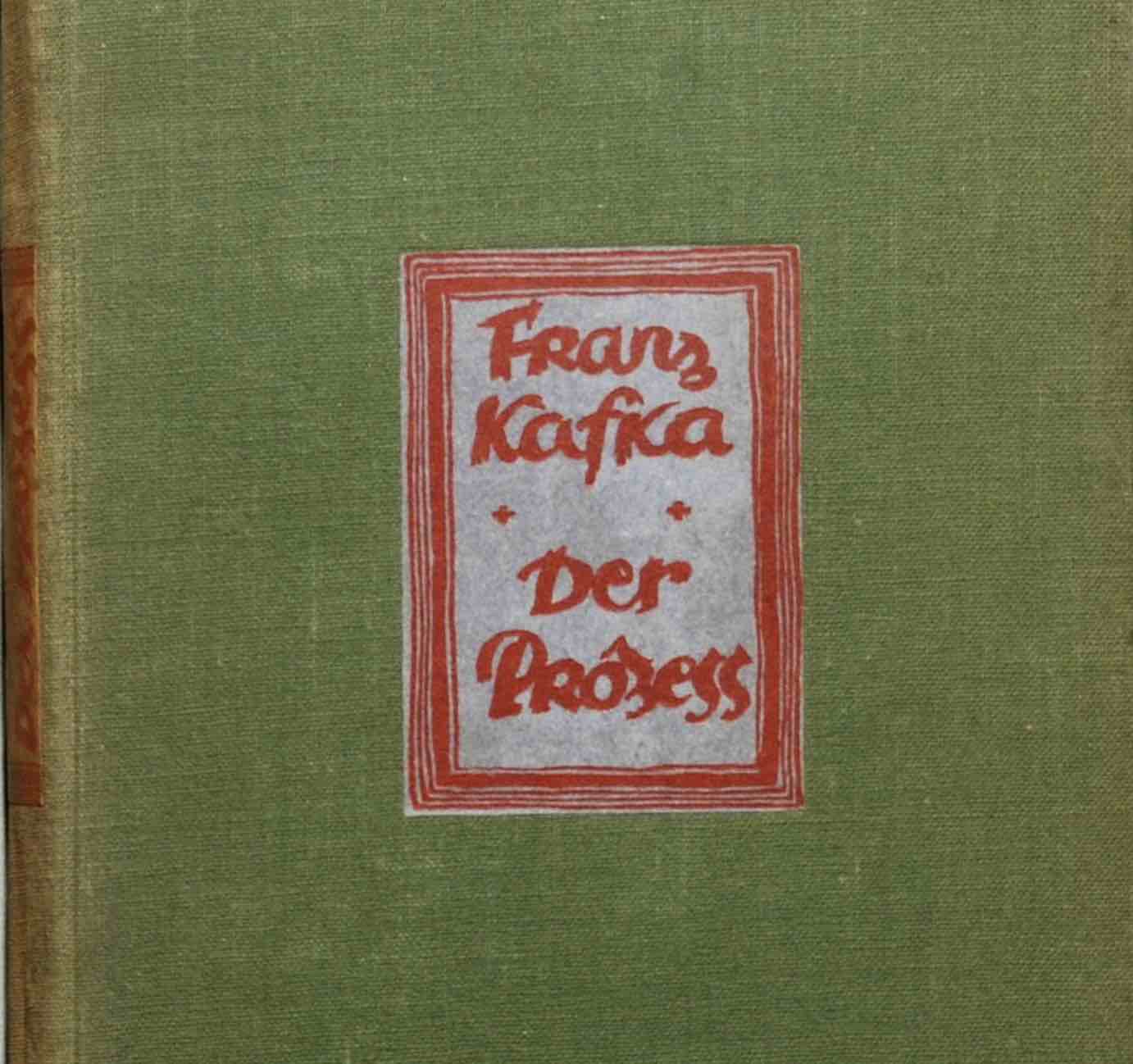

We are all Josef K

- Martin Enlund

- 11/24/23

TL;DR: We are increasingly treated like Josef K, the protagonist in Franz Kafka’s novel The Trial. Perhaps not by the usual legal system but within the ‘shadow judiciary’ of major corporations’ user agreements and the regulatory framework of the financial sector.