Is fiat money really money?

- Martin Enlund

- 11/7/22

Truth be told, investing legend Hugh Hendry had a point when he recently said that “central bankers don’t understand money, they only pretend”. But before we merely assign blame to this modern clergy of ours, one might as well note that few of us actually seem to understand money.

The essence of money does deserve to be discussed however, even by non-central bankers. After all, central bank bureaucrats and other gosplanners are rushing ahead with the introduction of central bank currencies (CBDCs), which will lead to radically different money - perhaps an even bigger change than when the dollar was decoupled from gold.

The global financial system is also undergoing major changes, not only due to extreme debt burdens, as a consequence of deglobalisation, but also from its increasing use as a weapon - sometimes even against domestic individuals and organisations. In the midst of it all, there’s the rise of Bitcoin and cryptocurrencies, which many find difficult to understand. But such difficulties are probably at least partially rooted in a lack of understanding of money as a phenomenon.

The usual economist definition is that something must fulfill three conditions to constitute money: 1) you must be able to use it for payments (it is a means of payment), 2) prices must be stated in its units (it is a unit of account) , and 3) it must store value over time (it’s a store of value).

Are these three conditions fulfilled with modern fiat currencies?

Means of payment: swiping your deposit card in the grocery store or paying with Apple Pay generally both work well, but when was the last time you managed to pay with cash? Cash does not meet the first criterion very well, at least not in countries such as Sweden. Swedish cash thus fails to fulfil this condition and hence is thus not real money. What’s more, if the electrical grid fails, or if the internet faces disruptions, money in your bank account probably won’t be money either since cash registers will fail to work.

Unit of account: it is generally the case that the prices in your local supermarket will be stated in your local currency, be it US dollar, euros or Swedish kronor. Dollars and euros will however have a higher “moneyness” in this regard than more peripheral currencies such as the krona since you will find prices quoted in Euros in Sweden at times, but only seldom krona prices in the Euro area.

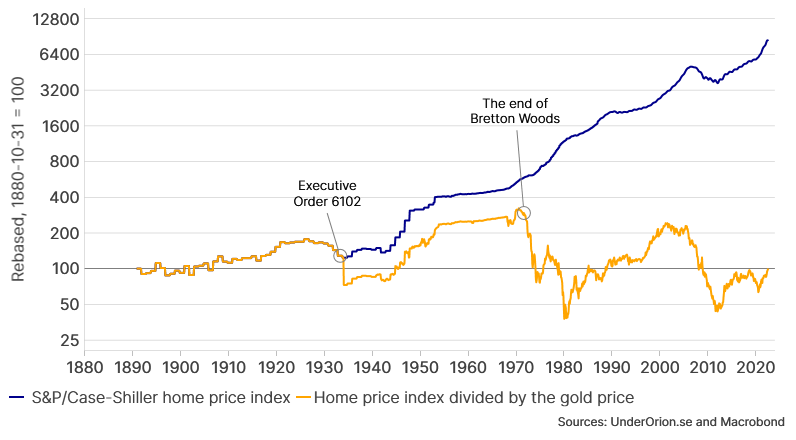

Store of value: with an inflation target of 2%, the purchasing power of cash will halve in 35 years. With the latest US CPI inflation rate at 8.2%, which was the measured outcome for the month of September, purchasing power will be halved in less than eight years. What’s more, while it is generally believed that US house prices have been rising, that is not the the case if we adjust for the price of gold (both the Swedish krona and the dollar used to be linked to gold). US house prices have then moved sideways for 140 years, while Swedish house prices - even in the capital area - have fallen(!).

Figure 1. US home price index - prices flat for 140 years?

We can also construct a table comparing fiat money in your bank account to cash, gold and Bitcoin, in a “battle of different moneys”. The point is primarily to show that money - or moneyness - is a fairly complicated question.

Table 1. Comparison of different moneys

| Condition | Bank account | Cash | Gold | Bitcoin |

|---|---|---|---|---|

| Means of payment | Yes | Sometimes | No | Rarely |

| Unit of account | Yes | Yes | No | Rarely |

| Store of value | No | No | Yes | Unclear |

| Is money? | No | No | No | No |

No innocence equals less moneyness

What’s more, what did it matter that Canadian truckers had “money” in their accounts when banks - cheered on by the government - stopped them from using it? At that time, their Canadian dollars did not work as a means of payment or as a store of value. Their money turned out to not be money at all. (The financial system is increasingly being used as a weapon, or even as a political tool, see here).

With today’s AML (anti-money laundering) and KYC (know your customer) regulations there’s also no longer a presumption of innocence. Your money isn’t yours unless you can prove it. “Gunnar cashed in SEK 311,500 - the Swedish central bank kept the money” is one of many nasty headlines in recent years. This loss of innocence has undermined the role of cash further. Even companies are at times required to provide written reports or invoice copies to their banks in order to receive payments. This loss of the presumption of innocence, and a tsunami of bureaucratic hassle, has translated to less moneyness for fiat currencies.

Indeed, the money we are most used to has moved far away from the typical definition of money. Fiat money stopped being real money years ago.

It will get worse in the near future

Central banker Neel Kashkari said something surprising the other month, surprising because he said it in his his capacity as the head of the Federal Reserve Bank of Minneapolis:

I keep asking anybody, anybody at the Fed or outside of the Fed, to explain to me what problem this is solving (…) I can see why China would do it. If they want to monitor every transaction you could do that with a central bank digital currency, you can’t do that with Venmo. If you want to impose negative interest rates, you can do that with a central bank digital currency, you can’t do that with Venmo. And if you want to directly tax customer accounts you could do that with a central bank digital currency, you can’t do that with Venmo. So I get why China would be interested. Why would the American people be for that?

With CBDCs, the authorities will be able to program your money so that it can only be spent on certain goods and services, see for instance the words of Sir Jon Cunliffe, deputy Governor at the Bank of England:

You could think of giving your children pocket money, but programming the money so that it couldn’t be used for sweets. There is a whole range of things that money could do, programmable money, which we cannot do with the current technology.

CBDCs will enable absolute control, as stated by BIS’ general manager Agustin Karstens:

The main difference between cash and CBDC is that central banks will get absolute control over rules and standards that would define the use of CBDCs; and we’ll also get the technology for ensuring its compliance.

Once CBDCs are implemented broadly, fiat money will become even less like real money. The central bank - or government - will be able to prevent spending (ex ante), not only monitor or tax it after the fact (ex post). Is such “money” still a means of payment? Not at all. With CBDCs, there will be no limit how deep into negative territory interest rates can be steered.

The government will also be able to automatically tax or withdraw funds from your account, perhaps if you fail to show the proper sign. CBDCs will make fiat money an even worse store of value. Only the unit of account condition will be fulfilled with CBDCs (Compliance-Based Decay Coins?).

Table 2. Comparison of different moneys, including CBDCs

| Condition | Bank account | Cash | Gold | Bitcoin | CBDCs |

|---|---|---|---|---|---|

| Means of payment | Yes | Sometimes | No | Rarely | No |

| Unit of account | Yes | Yes | No | Rarely | Yes |

| Store of value | No | No | Yes | Unclear | No |

| Is money? | No | No | No | No | No |

How about planning for an escape? Not so fast, there will be no one escaping today’s gosplanners, it would seem. In the words of ECB President Christine Lagarde: “there has to be regulation (…) at a global level because if there is an escape that escape will be used”.

The current crop of central bankers not only seem preoccupied with control - even absolute control, but also with preventing escape. What does that remind you of? Perhaps Tolkien can give us a clue.

Tolkien once rhetorically asked his friend C.S. Lewis:

What class of men would you expect to be most preoccupied with, and hostile to, the idea of escape?

He then gave the obvious answer:

Jailers.

If you wish to subscribe, sign up here!

Cover image found somewhere on twitter.