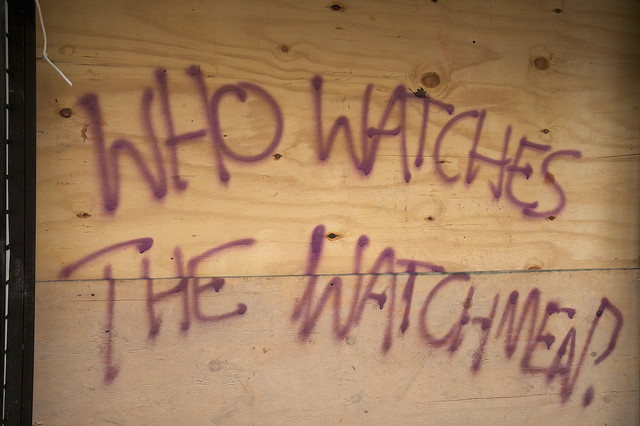

Pride comes before a fall

- Martin Enlund

- 3/31/24

The Governor of the Swedish Central Bank, Erik Thedéen, recently expressed significant skepticism about Bitcoin and cryptocurrencies as a phenomenon, dismissing Bitcoin as “an instrument for pure speculation.” He also pointed out that if there is no possibility to expose oneself to Bitcoin in the Swedish financial system, it might end up “more in criminal hands.” The European Central Bank is on the same track. In a recent blog post, they amused themselves by comparing Bitcoin ETFs to “the Emperor’s new clothes.”

Some would argue that central banks such as the ECB and the Swedish Riksbank should focus on their demonstrated inability to maintain “price stability” (their actual main mandate) rather than diligently focusing on diversity, inclusion, equity, climate, or crypto. In this case, the enthusiastic ECB bloggers expressed the opinion that Bitcoin and crypto are the currencies of criminals in a subheading titled “[t]he currency of crime: financing evil.” It sounds thrilling. But how significant is the problem, really?

The US Department of the Treasury releases an annual report on money laundering, in which we can read that “the use of virtual assets for money laundering remains far below that of fiat currency” and that “drug-related darknet market sales amounted to approximately $315 million annually, or about 0.2 percent of the combined estimated illicit annual retail drug sales in the United States and European Union”. Illicit activies are sure to occur among cryptocurrencies; however, the sums barely even constitute a rounding error in the grand scheme of things. Fiat currencies, i.e., money primarily created by commercial banks but also by central banks, are significantly more used for criminal purposes. What’s more, the current rules and regulations against money laundering and such are so ineffective so as to invite ridicule - if not their point is to terrorize innocent citizens.

Jamie Dimon, CEO of J.P. Morgan (the largest bank in the USA) rejected Bitcoin as a pet rock earlier this year, seeing only illegitimate use cases for it such as money-laundering and fraud. Again, one could question whether the concerned party should not care about the beam in their own eye - since the turn of the millennium, J.P. Morgan has been forced to pay roughly 40 billion dollars for its involvement in 275 shady affairs. And these are just the irregularities that have been discovered - perhaps they are but the tip of an iceberg?

In Denmark, there are suspicions that a bank may be involved in a money laundering scandal involving up to 200 billion euro, equivalent to funding half a million 9/11 attacks. For now, we set aside the fact that the central banks of France, Sweden, and other central banks have been used to finance wars, and that the Bank of England once concealed its war financing from the public “through masterful manipulation”. Unfortunately, we must even so conclude that we are dealing with vertical disinformation when someones claims that Bitcoin or cryptocurrencies is the “currency of crime”. The true currencies of crime are the fiat currencies we are most used to.

Our societies would greatly benefit if bureaucrats and bank officials refrained from speaking in absolute terms about bitcoin or cryptocurrencies (technologies they clearly do not understand), if they ceased disseminating misinformation (somehow fact-checkers are conveniently absent when influential individuals lie), and if they started to embrace humility.

But then again, pride does comes before a fall.

If you wish to subscribe, sign up here!

Cover image created with Dall-E